Complete details of Atal Pension Yojana | Calculator | Statements

In today’s fast-paced world, planning for your retirement is essential. Atal Pension Yojana (APY) is a government-backed pension scheme that was launched in India to provide financial security to unorganized sector workers. In this article, we will discuss everything you need to know about Atal Pension Yojana including its features, eligibility criteria, benefits and how to apply.

Table of Contents

What is Atal Pension Yojana?

Atal Pension Yojana is a government scheme launched in 2015. It is named after former Prime Minister Atal Bihari Vajpayee, who had the vision of providing financial security to unorganized sector workers during their old age. APY is administered by the Pension Fund Regulatory and Development Authority (PFRDA) and aims to provide a stable income to those working in the unorganized sector.

Features of Atal Pension Yojana

Fixed Pension Amount:

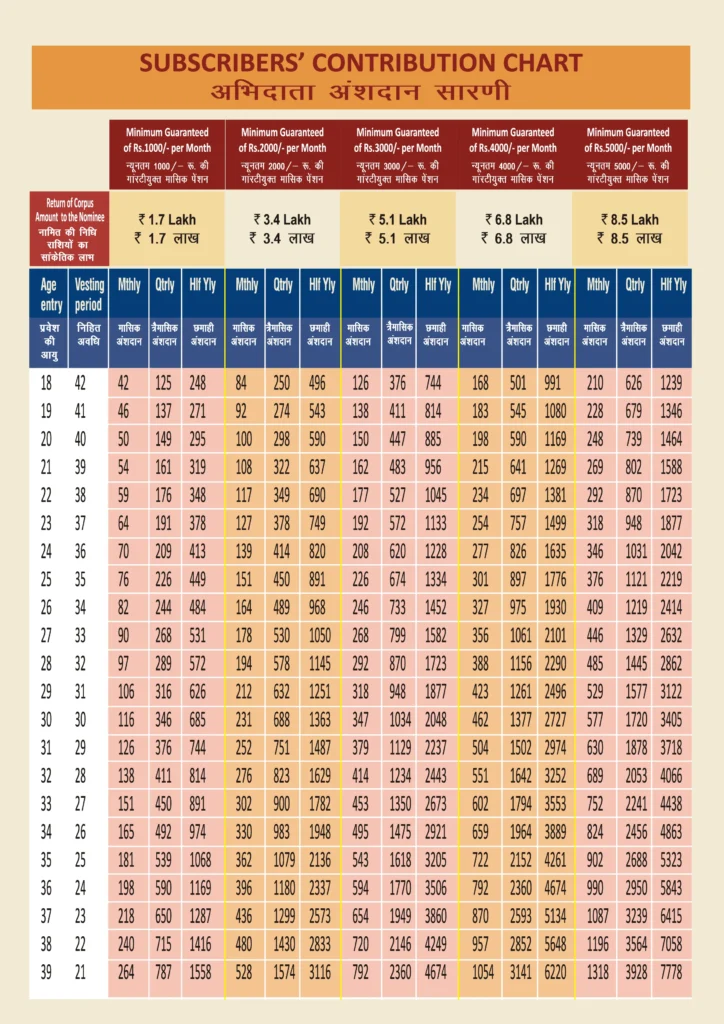

APY scheme provides a fixed pension amount to the subscriber after retirement, ranging from Rs. 1,000 to Rs. 5,000 per month.

Guaranteed Pension:

The pension amount is guaranteed by the government, which means that the subscriber will receive a fixed pension amount, irrespective of the returns generated by the investment.

Contribution Period:

The contribution period for APY ranges from 20 to 42 years, depending on the age of the subscriber. The subscriber needs to make contributions during this period in order to receive pension benefits.

Eligibility:

Any Indian citizen in the age group of 18 to 40 years can enroll in Atal Pension Yojana.

Enrollment:

Subscriber can nominate his/her spouse to receive the pension amount in case of death of the subscriber.

Benefits of Atal Pension Yojana

Financial Security:

APY ensures financial security during the old age of the subscriber by providing a fixed pension amount.

Tax Benefits:

Contribution made to Atal Pension Yojana is eligible for tax benefits under section 80CCD of the Income Tax Act.

Portable:

The plan is portable, which means subscribers can continue with the plan from anywhere in the country, even if they change their location.

Low Contribution:

The contribution amount for the scheme is low, starts from Rs. 42 per month, which makes it affordable for all.

How to apply for Atal Pension Yojana?

Online:

Subscriber can apply for APY online through the National Pension System (NPS) website or the website of any other authorized bank.

Offline:

The subscriber can also visit any authorized bank or post office to apply for Atal Pension Yojana.

Eligibility Criteria for Atal Pension Yojana

Age: The age of the customer should be between 18 to 40 years.

Bank Account: The customer should have an active bank account.

Aadhaar: Customer must have a valid Aadhaar card.

Income: The customer should not be an income tax payee.

Other Pension Schemes: The subscriber should not be a member of any other pension scheme.

How to check the status of Atal Pension Yojana?

Subscriber can check the status of his Atal Pension Yojana account by visiting the website of National Pension System (NPS) or by contacting the concerned bank.

Conclusion

Atal Pension Yojana is a great initiative by the Government of India to provide financial security to the unorganized sector workers during their old age. The scheme is affordable, portable and provides a fixed pension amount, which ensures a stable income after retirement. By enrolling in Atal Pension Yojana, subscribers can secure their future and lead a peaceful life after retirement. The plan is easy to enroll in and offers tax benefits, making it an attractive option for all. With the APY scheme, the government aims to improve the standard of living of the unorganized sector workers and help them lead a dignified life during their old age.